Mercury vs. Safeco Car Insurance for 2025 (See Rates & Reviews Here!)

When comparing Mercury vs. Safeco car insurance, Mercury is the better choice for most drivers. While Safeco is slightly cheaper, with rates starting at $71 per month, Mercury has a higher A.M. Best rating and fewer customer complaints logged on the NAIC than Safeco.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Mar 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Mar 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,277 reviews

1,277 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

1,277 reviews

1,277 reviewsOur analysis of Mercury vs. Safeco car insurance found that while both companies are very similar, Mercury has fewer NAIC complaints, putting it ahead of Safeco for customer satisfaction.

Delving into the comparison between Mercury and Safeco Car Insurance, our analysis unveils distinct insights on insurance rates influenced by critical factors: credit score, mileage, coverage level, and driving record.

Mercury vs Safeco Car Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 3.5 | 3.3 |

| Business Reviews | 3.5 | 3.0 |

| Claim Processing | 3.0 | 3.5 |

| Company Reputation | 4.0 | 3.0 |

| Coverage Availability | 3.5 | 4.0 |

| Coverage Value | 4.0 | 3.5 |

| Customer Satisfaction | 3.5 | 3.0 |

| Digital Experience | 3.0 | 3.5 |

| Discounts Available | 3.5 | 3.0 |

| Insurance Cost | 3.5 | 3.5 |

| Plan Personalization | 3.0 | 3.5 |

| Policy Options | 3.5 | 3.0 |

| Savings Potential | 3.5 | 3.0 |

| Mercury Review | Safeco Review |

While Mercury emerges as the frontrunner, Safeco also has advantageous rates, especially for those with higher mileage and a clean driving history.

If you are looking for affordable coverage in your area, enter your ZIP in our free quote tool. It will compare rates from the best cheap car insurance companies in your area.

- Safeco’s rates are slightly cheaper on average than Mercury’s

- Mercury has an A++ rating for financial strength from A.M. Best

- Mercury has fewer complaints from customers on the NAIC

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Mercury vs. Safeco Car Insurance Rates

When it comes to cost, the price of car insurance varies depending on factors such as the driver’s age, location, driving record, and the types of car insurance coverage needed. See how Safeco vs. Mercury insurance rates by coverage level and age compare below.

Mercury vs. Safeco Full Coverage Car Insurance Monthly Rates

| Age & Gender | ||

|---|---|---|

| 16-Year-Old Female | $384 | $344 |

| 16-Year-Old Male | $391 | $360 |

| 30-Year-Old Female | $87 | $77 |

| 30-Year-Old Male | $91 | $79 |

| 45-Year-Old Female | $78 | $72 |

| 45-Year-Old Male | $77 | $71 |

| 60-Year-Old Female | $69 | $63 |

| 60-Year-Old Male | $72 | $64 |

According to J.D. Power’s 2021 U.S. Auto Insurance Study, both Mercury and Safeco rank above average in terms of pricing, with Safeco ranking particularly high in the price category.

Based on the average rates, Mercury may be the more expensive choice. Next, see how the companies’ rates compare for different driving records.

Mercury vs. Safeco Full Coverage Car Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $77 | $71 |

| Not-At-Fault Accident | $114 | $110 |

| Speeding Ticket | $95 | $89 |

| DUI/DWI | $126 | $122 |

Mercury is slightly more expensive than Safeco in pricing, but not by an enormous amount.

Bear in mind that rates are just one part of a company’s rating, there are also coverages, discounts, reviews, and more to consider.

Car Insurance Coverage Options at Mercury vs. Safeco

Both Mercury and Safeco offer a range of car insurance products and services, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

In addition, both companies offer optional coverage such as rental car reimbursement, custom equipment coverage, and roadside assistance (Read More: Best Car Insurance for Towing and Roadside Assistance).

Car Insurance Coverage Options: Mercury vs. Safeco

| Coverage Name | ||

|---|---|---|

| Liability | ✅ | ✅ |

| Collision | ✅ | ✅ |

| Comprehensive | ✅ | ✅ |

| Uninsured/Underinsured Motorist | ✅ | ✅ |

| Medical Payments (MedPay) | ✅ | ✅ |

| Personal Injury Protection (PIP) | ✅ | ✅ |

| Rental Car Reimbursement | ✅ | ✅ |

| Roadside Assistance | ✅ | ✅ |

| Rideshare Coverage | ✅ | ✅ |

| Accident Forgiveness | ❌ | ✅ |

The only coverage difference is accident forgiveness, which Safeco offers but Mercury does not. Accident forgiveness isn’t offered by all insurance companies.

Accident forgiveness is a perk meant for safe drivers, as the company will forgive a first accident and won’t raise rates.

Car Insurance Discounts From Mercury and Safeco

Both Mercury and Safeco offer a variety of discounts to help customers save on their car insurance premiums.

Take a look at the full list of car insurance discounts for both companies below.

Mercury vs Safeco Car Insurance Discounts

| Discount | ||

|---|---|---|

| Low Mileage | 10% | 26% |

| Senior Driver | 15% | 20% |

| Safe Driver | 12% | 20% |

| Anti Theft | 5% | 12% |

| Good Student | 8% | 11% |

| Paperless | 7% | 7% |

A discount offered by both companies includes safe driver discounts for drivers with a clean driving record.

Drivers can save at Safeco by joining RightTrack and earning discounts for safe driving habits (Learn More: Safeco RightTrack Review). Safeco also offers a diminishing deductible for safe drivers who are accident and claim-free.

Both Mercury and Safeco also offer anti-theft device discounts for customers who install anti-theft devices in their vehicles.

There are also multi-car discounts for customers who insure multiple vehicles with the same company and bundling discounts for customers who purchase multiple types of insurance policies, such as car and home insurance. Combining these discounts can result in significant savings.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Customer Reviews of Mercury and Safeco

When it comes to choosing a car insurance provider, customer reviews can be a valuable source of information. Take a look at the Reddit thread about Mercury Insurance below to see what customers are saying.

Does anyone have any experience with Mercury Car Insurance?

byu/GibsonMaestro inAskLosAngeles

While some customers have positive things to say about Mercury Insurance, a common complaint among prior customers is that Mercury’s claim department is lacking.

Safeco has similar results when you read customer reviews, while recommended by some, others aren’t as happy with Safeco.

Negative feedback about Safeco discusses denied claims and increasing rates. Customers also complain about the lack of responsiveness from Safeco’s customer service, with long wait times and unhelpful representatives.

Of course, mixed reviews are common, as not everyone will have a great auto insurance claims experience. However, if more reviews are negative than positive, this could point to an issue with the company.

Business Ratings of Mercury and Safeco

Reputable business ratings of an insurance company can give you insight into a company that goes beyond just customer satisfaction. You can also look at ratings for business practices, financial health, and more.

Mercury and Safeco have been rated by several important companies, including BBB, A.M. Best, and J.D. Power.

Insurance Business Ratings & Consumer Reviews: Mercury vs Safeco

| Agency | ||

|---|---|---|

| Score: 816 / 1,000 Avg. Satisfaction | Score: 844 / 1,000 Above Avg. Satisfaction |

|

| Score: A Excellent Business Practices | Score: A Excellent Business Practices |

|

| Score: 70/100 Positive Claims Handling | Score: 74/100 Good Customer Feedback |

|

| Score: 0.84 Fewer Complaints Than Avg. | Score: 0.90 Fewer Complaints Than Avg. |

|

| Score: A++ Superior Financial Strength | Score: A Excellent Financial Strength |

According to J.D. Power’s U.S. Auto Insurance Study, Safeco received above-average ratings in terms of overall customer satisfaction.

Mercury receives particularly high ratings for its claims handling process, while Safeco receives high ratings for its pricing and billing process.

J.D. Power is a trustworthy source that rates auto insurance companies based on customer satisfaction surveys.Daniel Walker Licensed Insurance Agent

J.D. Power evaluates factors such as claims satisfaction, pricing, policy offerings, and customer service to provide an overall score.

As for A.M. Best, Mercury has a much better A.M. Best rating of A++, which means it is better equipped to pay out auto insurance claims (Learn More: How do insurance companies pay out claims?).

Pros and Cons of Mercury Car Insurance

Pros:

- Customizable Coverage Options: Mercury provides customizable coverage options like rental car reimbursement (Learn More: Does Mercury Insurance car insurance cover rental reimbursement if my car is being repaired?).

- Personalized Customer Service: Known for a strong reputation in personalized customer service, Mercury aims to assist customers in selecting the right coverage. Mercury also receives above-average ratings in customer satisfaction, particularly in claims handling.

- Competitive Pricing: Mercury is recognized for competitive pricing, appealing to cost-conscious drivers.

Cons:

- Limited Coverage Area: Coverage is available in 11 states, potentially limiting options for those outside the covered regions.

- No Accident Forgiveness: Mercury doesn’t offer accident forgiveness to safe drivers.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of Safeco Car Insurance

Pros:

- Extensive Discounts: Safeco offers a wide array of discounts, making it an attractive option for those seeking affordability. Safeco may be most affordable for drivers with a clean record, as it the Safeco RightTrack program rewards good drivers.

- National Coverage: With coverage in all 50 states, Safeco provides a broader reach compared to Mercury.

- Positive Customer Reviews: Receives above-average ratings in customer satisfaction, especially in pricing and billing.

Cons:

- Less Customization: Compared to Mercury, Safeco may offer less flexibility in terms of customizable coverage options.

- Potentially Higher Rates for Specific Drivers: While affordable for good drivers, rates may vary for individuals with specific coverage needs, such as drivers needing high-risk car insurance.

History of Mercury vs. Safeco

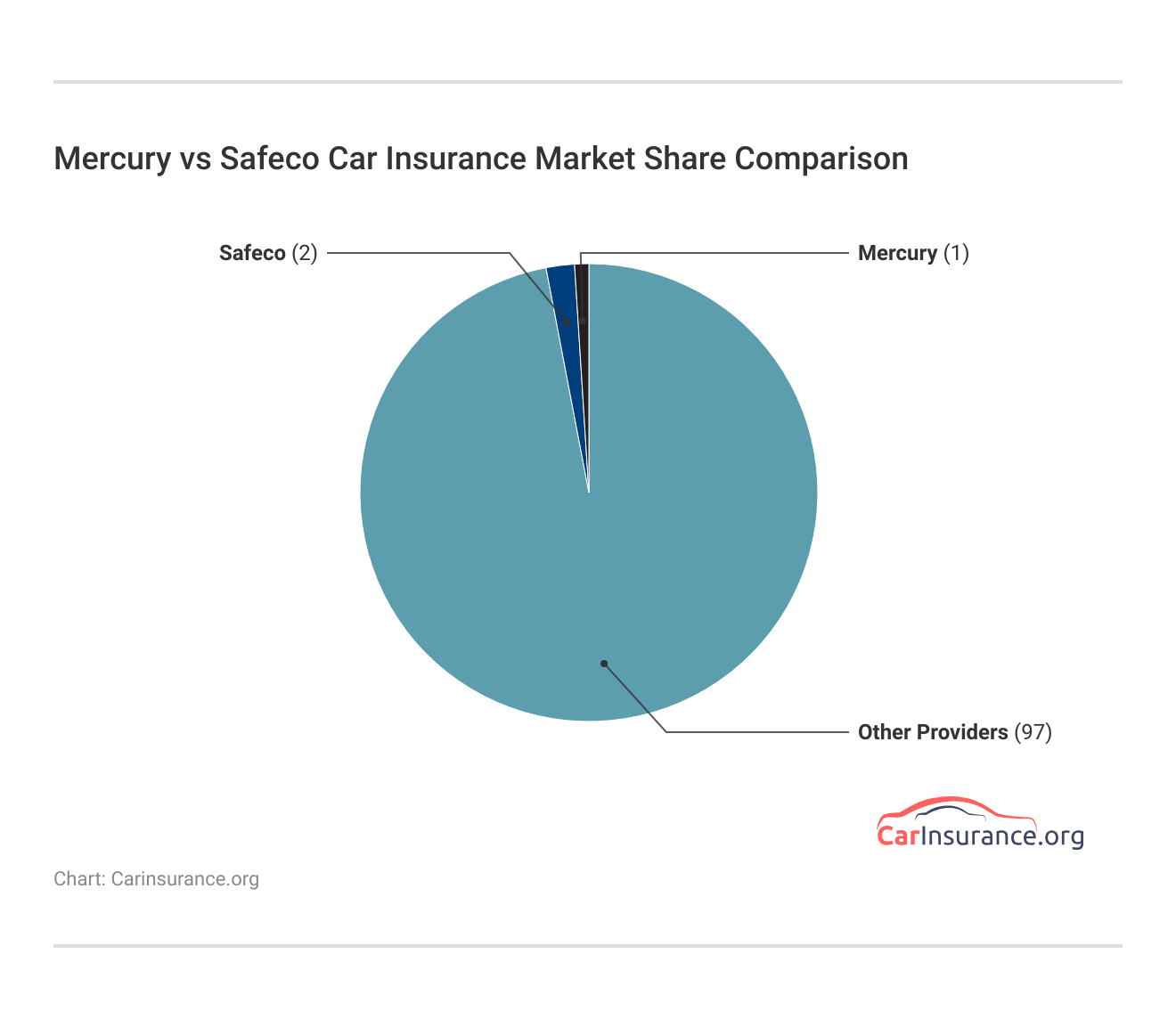

Both companies have been around for at least a few decades and have decent market shares in the insurance industry. Mercury has a slightly smaller market share than Safeco, as it sells in fewer states.

Both Mercury and Safeco are smaller auto insurance companies. They will have much smaller market shares if you compare them to popular companies, like Geico vs. Safeco or USAA vs. Mercury (Read More: Are smaller insurance companies better?).

Mercury Insurance was founded in 1962 by George Joseph, who aimed to provide affordable and reliable car insurance to California drivers. Today, the company has expanded to offer coverage in 11 states, including Arizona, Florida, Georgia, Illinois, Nevada, New Jersey, New York, Oklahoma, Texas, and Virginia.

Mercury’s mission is to provide high-quality insurance products and services to customers, with a focus on personalized customer service and competitive pricing.

Safeco Insurance was founded in 1923 in Seattle, Washington, and has since grown to become a national insurance provider with coverage in all 50 states. The company’s mission is to provide peace of mind to its customers by offering reliable and affordable insurance products, including car insurance, home insurance, and umbrella insurance.

Case Studies for Mercury vs. Safeco Car Insurance

Case Study #1: Mercury Car Insurance Customizable Coverage Options

Mercury Insurance, founded in 1962, has a long history of providing affordable and reliable car insurance to California drivers. Recently, a customer named John was seeking comprehensive coverage that catered to his specific needs. John’s driving habits involved long commutes, and he wanted to ensure he had adequate coverage for roadside assistance and rental car reimbursement in case of emergencies.

Learn More: If my car breaks down, will insurance cover a rental?

After comparing various insurance providers, John found the offerings from Mercury auto insurance particularly appealing due to their customizable coverage options. The company allowed him to tailor his policy to include the exact coverage he required.

John found Mercury’s customizable coverage options and competitive pricing appealing to his specific needs.

Additionally, Mercury’s strong reputation for personalized customer service and competitive pricing further convinced John to choose them as his car insurance provider.

Case Study #2: Safeco Car Insurance Affordability and Extensive Discounts

Safeco Insurance, with its founding dating back to 1923 in Seattle, Washington, has established itself as a national insurance provider with coverage across all 50 states. Emily, a young driver with a clean driving record, was searching for an affordable car insurance plan that offered essential coverage without breaking the bank.

Emily came across Safeco and was impressed by the wide array of discounts the company offered, particularly the RightTrack program for safe driving.

She was also eligible for a good student discount and received additional savings for using certain safety features in her vehicle.

With Safeco’s focus on providing peace of mind through reliable and affordable insurance products, Emily found her ideal car insurance solution.

Case Study #3: Comparison Shopping and Customer Satisfaction

Both Mercury and Safeco have built a reputation for offering quality products and services, making it challenging for potential customers to decide between the two. Julia, a cautious driver, wanted to ensure she made the best choice for her car insurance needs.

Julia took advantage of the free online quote tool provided by a third-party resource that allowed her to compare rates from multiple car insurance companies, including Mercury and Safeco. After reviewing the quotes side-by-side and considering customer reviews from J.D. Power’s 2021 U.S.

Learn More: How to Buy Car Insurance

Auto Insurance Study, Julia found that both companies received above-average ratings in customer satisfaction. This made her confident in her decision to choose either of them based on her specific coverage requirements.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Claims With Mercury vs. Safeco Car Insurance

When it comes to filing a car insurance claim with Mercury and Safeco car insurance, both companies offer multiple convenient methods for policyholders. Customers can choose to file claims online through their respective websites, over the phone by contacting the dedicated claims hotline, or by utilizing mobile apps designed to streamline the claims process.

These options provide flexibility and cater to various preferences, ensuring that policyholders can report incidents in a manner that suits their needs.

Average Claim Processing Time

The speed at which an insurance company processes claims can significantly impact the customer experience. Both Mercury and Safeco are known for their efficient claim processing.

On average, they strive to handle claims promptly, aiming to minimize disruptions and provide timely assistance to policyholders during stressful situations. While claim processing times can vary based on the complexity of the claim and damages, customers can generally expect a responsive approach to their claims (Read More: How do car insurance companies calculate damages?).

Customer Feedback on Claim Resolutions and Payouts

Customer feedback plays a crucial role in assessing an insurance company’s performance in claim resolution and payout. Both the Mercury Insurance mobile app and Safeco insurance app have received positive feedback from their policyholders regarding the fair and satisfactory resolution of claims, with no more than a normal amount of disputes.

Learn More: How do I dispute the amount of a car insurance claim?

Their commitment to transparency and fairness in the claims process is reflected in the trust they have built with their customers. Policyholders often report a smooth claims experience, from initial reporting to the final settlement.

Mercury vs. Safeco Car Insurance Digital and Technological Breakthroughs

In today’s digital age, mobile apps have become an integral part of the insurance experience. Both Mercury and Safeco offer feature-rich mobile apps that allow policyholders to manage their insurance policies on the go.

These apps typically provide functionalities such as policy access, bill payments, claims reporting, and even roadside assistance requests.

Auto insurance apps usually allow customers to easily change coverages, file claims, pay bills, and track the status of claims.Dani Best Licensed Insurance Producer

Online account management is another crucial aspect of modern insurance. Policyholders of Mercury and Safeco can log in to their online accounts through the company’s websites at www.mercuryinsurance.com and www.safeco.com.

The intuitive online account interfaces enhance the overall customer experience by providing easy access to essential services. These online portals enable customers to view and manage their policies, access policy documents, update personal information, and make payments conveniently.

Read More: Is it safe to buy car insurance online?

Both Mercury and Safeco also understand the importance of providing digital tools and resources to educate and assist their policyholders. These tools may include online calculators for coverage assessment, informative articles, educational videos, and resources for safe driving practices.

By offering these digital resources, both companies aim to empower their customers with the knowledge and tools necessary to make informed decisions about their insurance coverage and driving habits.

Choosing Between Mercury and Safeco

After a comprehensive review of Mercury and Safeco car insurance, both companies are solid options for car insurance. Both companies receive positive customer reviews, although Mercury has fewer complaints lodged on the NAIC, emphasizing its commitment to customer satisfaction.

The emphasis on fair and satisfactory claim resolution further solidifies Mercury’s reputation. Mercury excels in providing user-friendly digital tools and resources.

Both companies offer feature-rich mobile apps and online account management.

Safeco is another solid second choice with the following to offer customers. Safeco stands out for its extensive range of discounts that help customers get the best full-coverage car insurance rates.

Safeco’s nationwide coverage in all 50 states provides a broader reach compared to Mercury’s presence in only 11 states. This accessibility ensures that Safeco can serve a more extensive customer base, offering consistency and convenience.

Whether you are comparing Allstate vs. Safeco or Geico vs. Mercury, make sure to fully consider the pros and cons of each company before making your choice. If you are looking to find a great auto insurance provider in your area today, use our free quote tool.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What are some key differences between Mercury and Safeco car insurance?

Mercury Insurance Services, LLC tends to offer more customizable coverage options, while Safeco Insurance Company of America may have more extensive discounts and online tools. Additionally, Mercury may be more suitable for drivers with higher coverage needs, while Safeco may be more affordable for drivers with a clean driving record.

How can I compare rates between Mercury and Safeco car insurance?

The best way to compare rates is to request quotes from both providers and compare them side-by-side. Be sure to provide accurate information about your vehicle, driving history, and coverage needs to get the most accurate quotes.

What types of discounts do Mercury and Safeco car insurance offer?

Both companies offer a variety of discounts, including safe driver discounts, multi-policy discounts, and good student car insurance discounts. Safeco also offers discounts for using certain safety features on your vehicle and for being a member of certain organizations.

How do I file a claim with Mercury or Safeco car insurance?

Both companies offer multiple ways to file a claim, including online, by phone, and through a mobile app. Check your policy documents or contact customer service for specific instructions on how to file a claim with your provider.

Is Mercury a good car insurance company?

Yes, Mercury has an A++ rating from A.M. Best. However, it is only available in 11 states, so you might need to compare different companies if they are not available in your state, like MetLife vs. Safeco or State Farm vs. Safeco. Enter your ZIP code in our free tool to find the best car insurance company available in your area.

What is better than Safeco insurance?

There are some companies with better A.M. Best ratings than Safeco. For example, Geico has an A++ A.M. Best rating, which is better than Safeco when comparing Safeco vs. Geico. Make sure to consider company ratings, rates, and eligibility when comparing companies like Safeco vs. State Farm or Progressive vs. Safeco.

For example, USAA has better A.M. Best ratings than Safeco when you compare USAA vs. Safeco, but USAA is only sold to military and veterans (Learn More: USAA Car Insurance Review).

Why is Safeco insurance so expensive?

Safeco Insurance is owned by Liberty Mutual, which is one of the pricier auto insurance companies. Your rates may also be high due to your driving record, area, and other factors.

Can you trust Mercury?

Yes, Mercury General Corporation is a trustworthy company with an A++ rating from A.M. Best.

What insurance company is better than Mercury?

There are a few companies with more availability that may be a better fit for you, like Geico (Read More: Geico vs Mercury Car Insurance). However, make sure to consider all aspects of a company, whether you are comparing Mercury vs. USAA, Mercury vs. Progressive, or Mercury vs. Safe Auto.

For example, when comparing USAA vs. Mercury, USAA has better rates and ratings but is only available to military and veterans. Or when you compare Mercury vs. State Farm, Mercury has a better A.M. Best rating, as State Farm only has a B+ rating.

What is the Safeco AM Best rating?

Safeco has an A rating from A.M. Best.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.