Expert Tennessee Car Insurance Advice (Compare Costs & Companies)

Tennessee drivers need liability insurance in the amount of 25/50/15, which averages $31/mo. However, our expert Tennessee car insurance advice is to carry full coverage insurance that protects you and your car if you cause an accident. In Tennessee, full coverage is only an average of $111/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Jan 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Jan 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- On average, State Farm is the cheapest car insurance company in Tennessee

- Minimum liability car insurance in Tennessee is an average of $31 per month

- Full coverage car insurance in Tennessee is an average of $111 per month

Looking for expert Tennesee car insurance advice? We’ve created this guide to help you navigate Tennessee car insurance, rules of the road, and other vehicular safety information in Tennessee so that you can find the best Tennessee auto insurance policy for your needs.

Once you’re ready to start comparing Tennessee car insurance rates to find cheap car insurance in Tennessee, use our free comparison tool above. It will help you find the best Tennessee car insurance quotes from companies in your area.

Tennessee Car Insurance Coverage & Rates

Tennessee has a rich history.

Mountain Dew was invented here, a soda meant to be mixed with Tennessee whiskey. It’s the home of the Grand Ole Opry and the American Civil Rights Museum. Tennessee is a major hub for car manufacturing, and with nearly 5.5 million automobiles on the road, you know Tennesseeans love to drive.

Tennessee’s Car Culture

The good citizens of Tennessee love to drive.

- Best Cheap Car Insurance Companies

- Affordable Car Insurance Rates in Tazewell, TN (2025)

- Affordable Car Insurance Rates in Rogersville, TN (2025)

- Affordable Car Insurance Rates in Newport, TN (2025)

- Affordable Car Insurance Rates in Loudon, TN (2025)

- Affordable Car Insurance Rates in Jackson, TN (2025)

- Affordable Car Insurance Rates in Gallatin, TN (2025)

- Affordable Car Insurance Rates in Dandridge, TN (2025)

- Affordable Car Insurance Rates in Crossville, TN (2025)

- Affordable Car Insurance Rates in Centerville, TN (2025)

- Affordable Car Insurance Rates in Bristol, TN (2025)

Auto Alliance reports that in 2018 alone, nearly 275,000 new cars were sold in the state. As the state’s favorite son might say, that’s a hunka hunka lotta automobiles.

Whether you’re new to Tennessee, or a long-time resident, it’s important to know what kind of car insurance you need in The Volunteer State.

Check out the sections below to make your search for affordable and proficient car insurance in Tennessee a bit easier. Or enter your zip code below to get started on a quote today.

Enter your ZIP code below to view companies that have cheap auto insurance rates. Secured with SHA-256 Encryption

Tennessee Minimum Coverage

Driving without minimum car insurance coverage in Tennessee means you risk hefty fines and even the ability to drive at all in the state.

Tennessee’s Financial Responsibility Law requires drivers to maintain at least the minimum levels of liability car insurance coverage listed below.

This means that in Tennessee, your insurance must cover at least:

- $25,000 per person — to cover the bodily injury or death of an individual resulting from an accident you cause

- $50,000 per accident — to cover the total bodily injury or death liability resulting from an accident you cause

- $15,000 property damage liability coverage — to cover the total costs of another party or party’s property damage resulting from an accident you cause

Of course, this is just the minimum coverage required. Read on to explore how the better insured you are, the better prepared you will be in the case of an accident or other automobile incidents.

Forms of Financial Responsibility

Remember: you must also be able to show proof of insurance if you are ever pulled over by a law enforcement officer. (Luckily, Tennessee is one of 48 states that accepts electronic proof of insurance.)

The state’s Department of Revenue clearly lays out the acceptable forms of financial responsibility.

The easiest way to show proof of financial responsibility under Tennessee law is to get covered by an auto liability insurance policy that meets the required minimum limits ($25,000 for each injury or death per accident, $50,000 for total injuries or deaths per accident, and $15,000 for property damage per accident).

But there are other ways you can show proof of financial responsibility to satisfy your legal requirement under Tennessee law. These include:

- posting a bond with the Department of Revenue for $65,000.

- making a cash deposit with the Department of Revenue for $65,000.

Premiums as a Percentage of Income

In 2017, the average household income in Tennessee was $51,340. Though that’s significantly less than the national average of $60,336, incomes in Tennessee are growing more quickly than most places across the country.

From 2014 to 2017, the average household income in The Volunteer State grew by 11.66 percent.

As incomes continue to grow, Tennesseeans can expect to pay more for auto insurance.

So, how much of your income is going to be eaten up by car insurance rates in Tennessee? Use the calculator below to find out.

CalculatorPro

Average Monthly Car Insurance Rates in TN (Liability, Collision, Comprehensive)

Tennessee is a quickly-growing state, and that means insurance premiums may be on the rise.

The National Association of Insurance Commissioners (NAIC) provides the following averages for core car insurance in the state:

Tennessee Average Annual Car Insurance Rates by Coverage Type

| Car Insurance Coverage Type | Average Annual Car Insurance Rates |

|---|---|

| Comprehensive | $148.45 |

| Collision | $309.07 |

| Liability | $413.91 |

| Combined | $871.43 |

But you may want to increase the amount of insurance you carry based on a variety of factors and, often affordable, options. Let’s look into some of those factors and options.

Additional Liability

Like everywhere, Tennessee has a loss ratio for car insurance claims, or the amount companies pay out vs. the amount of premiums they collect. So, a company’s loss ratio is the percentage of losses they sustain compared to the premiums they are writing.

Think of it this way: if a company spends $650 in claims for every $1,000 they receive in premiums, they have a loss ratio of 65 percent.

Our research shows that a car insurer’s loss ratio should ideally be between 60 and 70 percent. The table below lists the loss ratios of Tennessee’s top insurers as of 2015.

Loss Ratios for Tennesse's Largest Car Insurance Companies

| Company | Direct Premiums Written | Loss Ratio |

|---|---|---|

| State Farm Group | $948,604 | 62.03% |

| Tennessee Farmers Group | $654,613 | 74.33% |

| Geico | $348,059 | 69.97% |

| Progressive Group | $311,706 | 61.15% |

| Allstate Insurance Group | $254,285 | 47.23% |

| USAA Group | $221,585 | 71.72% |

| Liberty Mutual Group | $211,928 | 62.66% |

| Nationwide Corp Group | $171,166 | 68.01% |

| Erie Insurance Group | $114,508 | 76.69% |

| Travelers Group | $84,329 | 64.98% |

Luckily, these ratios reveal that Tennessee car insurance companies are seeing healthy gains to losses overall for MedPay and uninsured/underinsured motorist coverage. That means lower premiums for you.

Add-ons, Endorsements, and Riders

The best coverage at an affordable premium is likely your number-one goal in shopping for car insurance. We get that, and we’re here to help.

Luckily, there are a lot of cheap but powerful extras you can add to your policy to ensure you are better-covered in case of an accident or other events.

Some useful add-ons you might consider in Tennessee are:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-You-Drive or Usage-Based Insurance

Have you considered Personal Injury Protection (PIP)? PIP, which a lot of folks call “no-fault insurance,” covers medical bills incurred from a wreck, regardless of who is at fault, who is driving, or who owns the vehicle.

Average Monthly Car Insurance Rates by Age & Gender in TN

Though Tennessee is not one of the six states (North Carolina, Hawaii, Massachusetts, Pennsylvania, California, and Montana) that have outlawed gender discrimination in car insurance premiums, our research shows that gender isn’t a huge difference-maker in premiums across the state.

As the table below shows, however, age and marital status certainly are factors relevant to car Insurers in The Volunteer State.

Tennessee Average Annual Car Insurance Rates by Age and Gender

| Companies | Average Annual Rates for a Married 60-Year-Old Female | Average Annual Rates for a Married 60-Year-Old Male | Average Annual Rates for a Married 35-Year-Old Female | Average Annual Rates for a Married 35-Year-Old Male | Average Annual Rates for a Single 25-Year-Old Female | Average Annual Rates for a Single 25-Year-Old Male | Average Annual Rates for a Single 17-Year-Old Female | Average Annual Rates for a Single 17-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| USAA | $1,397.27 | $1,398.41 | $1,548.81 | $1,577.29 | $2,023.45 | $2,157.82 | $5,501.37 | $6,309.85 |

| State Farm Mutual Auto | $1,452.60 | $1,452.60 | $1,612.16 | $1,612.16 | $1,821.23 | $2,116.70 | $4,907.17 | $6,139.77 |

| Progressive Hawaii | $1,519.40 | $1,588.93 | $1,864.12 | $1,757.10 | $2,246.65 | $2,451.94 | $8,386.68 | $9,440.45 |

| Travelers Prop Cas Ins Co | $1,606.70 | $1,710.20 | $1,767.42 | $1,860.42 | $1,882.49 | $1,981.27 | $4,956.52 | $6,143.14 |

| Mid-Century Ins Co | $1,631.91 | $1,788.38 | $1,817.48 | $1,850.03 | $2,457.63 | $2,601.27 | $7,410.65 | $7,883.17 |

| Nationwide Mutual | $1,964.40 | $1,997.15 | $2,192.98 | $2,211.90 | $2,520.95 | $2,739.66 | $6,012.22 | $7,760.40 |

| Geico General | $2,010.58 | $2,010.58 | $2,182.11 | $2,202.22 | $2,216.18 | $2,286.01 | $6,620.63 | $6,739.05 |

| Allstate P&C | $2,516.49 | $2,612.46 | $2,796.09 | $2,684.61 | $2,980.14 | $3,082.46 | $10,516.65 | $11,441.86 |

| SAFECO Ins Co of IL | $2,991.77 | $3,342.39 | $3,639.40 | $129.00 | $3,902.85 | $4,159.27 | $14,916.05 | $16,572.79 |

Cheapest Rates by Zip Code

Where are the most expensive car insurance rates on average in Tennessee? You can find those in zip code 38118, an area on the south side of Memphis just east of the airport.

The table below lists the 25 Tennessee ZIP codes with the lowest annual auto insurance rates.

Average Annual Car Insurance Rates in Tennessee's Cheapest ZIP Codes

| ZIP Codes | Cities | Average Annual Rates |

|---|---|---|

| 37601 | Johnson City | $5,266.60 |

| 37614 | Johnson City | $5,266.60 |

| 37620 | Bristol | $5,174.63 |

| 37692 | Unicoi | $5,368.79 |

| 37604 | Johnson City | $5,266.60 |

| 37684 | Mountain Home | $5,266.60 |

| 37690 | Telford | $5,266.60 |

| 37615 | Johnson City | $5,266.60 |

| 37643 | Elizabethton | $5,321.14 |

| 37694 | Watauga | $5,321.14 |

| 37650 | Erwin | $5,368.79 |

| 37659 | Jonesborough | $5,266.60 |

| 37663 | Kingsport | $4,961.30 |

| 37657 | Flag Pond | $5,368.79 |

| 37617 | Blountville | $4,961.30 |

| 37686 | Piney Flats | $5,321.14 |

| 37682 | Milligan College | $5,266.60 |

| 37618 | Bluff City | $5,321.14 |

| 37660 | Kingsport | $5,141.66 |

| 37680 | Laurel Bloomery | $6,063.27 |

| 37688 | Shady Valley | $6,063.27 |

| 37656 | Fall Branch | $5,141.66 |

| 37665 | Kingsport | $5,141.66 |

| 37664 | Kingsport | $5,445.99 |

| 37658 | Hampton | $6,049.58 |

In contrast, here are the 25 ZIP codes with the highest annual rates.

Average Annual Car Insurance Rates in Tennessee's Most Expensive ZIP Codes

| ZIP Codes | Cites | Average Annual Rates |

|---|---|---|

| 38118 | Memphis | $7,567.94 |

| 38112 | Memphis | $8,412.97 |

| 38128 | Memphis | $8,114.32 |

| 38132 | Memphis | $7,567.94 |

| 38116 | Memphis | $8,294.54 |

| 38131 | Memphis | $8,294.54 |

| 38126 | Memphis | $8,470.60 |

| 38111 | Memphis | $7,958.43 |

| 38127 | Memphis | $7,432.01 |

| 38122 | Memphis | $7,958.43 |

| 38107 | Memphis | $8,412.97 |

| 38115 | Memphis | $7,771.74 |

| 38105 | Memphis | $8,412.97 |

| 38108 | Memphis | $8,412.97 |

| 38114 | Memphis | $7,811.89 |

| 38109 | Memphis | $7,826.82 |

| 38106 | Memphis | $8,470.60 |

| 38152 | Memphis | $7,958.43 |

| 38104 | Memphis | $7,759.04 |

| 38141 | Memphis | $7,560.82 |

| 38163 | Memphis | $7,958.43 |

| 38103 | Memphis | $7,759.04 |

| 38157 | Memphis | $7,958.43 |

| 38125 | Memphis | $7,560.82 |

| 38134 | Memphis | $7,813.35 |

It’s easy to find the cheapest car insurance rates for you and your family. Just enter your zip code below to get started.

Enter your ZIP code below to view companies that have cheap auto insurance rates. Secured with SHA-256 Encryption

Rates in Tennessee’s Cities

When it comes to a lot of costs and policies, the urban vs. rural divide rules supreme in The Volunteer State.

The tables below offers average premiums in the state’s cities, from big-city Nashville to small-town Bristol.

Let’s start with a look at the cities with the lowest average rates.

Average Annual Car Insurance Rates in Tennessee's Cheapest Cities

| Cites | Average Annual Rates |

|---|---|

| Central | $3,173.65 |

| Bristol | $3,176.81 |

| Unicoi | $3,177.19 |

| Johnson City | $3,181.79 |

| Mountain Home | $3,188.99 |

| Telford | $3,197.59 |

| Gray | $3,199.74 |

| Elizabethton | $3,200.59 |

| Watauga | $3,210.85 |

| Banner Hill | $3,212.85 |

| Jonesborough | $3,217.01 |

| Colonial Heights | $3,220.96 |

| Flag Pond | $3,222.95 |

| Blountville | $3,226.34 |

| Piney Flats | $3,248.25 |

| Milligan College | $3,257.45 |

| Bluff City | $3,259.15 |

| Bloomingdale | $3,265.10 |

| Laurel Bloomery | $3,266.48 |

| Shady Valley | $3,269.32 |

| Fall Branch | $3,275.84 |

| Kingsport | $3,284.52 |

| Hampton | $3,294.15 |

| Roan Mountain | $3,298.94 |

| Limestone | $3,308.69 |

Let’s start with a look at the cities with the lowest average rates.

Average Annual Car Insurance Rates in Tennessee's Most Expensive Cities

| Cites | Average Annual Rates |

|---|---|

| Mc Lemoresville | $3,925.54 |

| Brunswick | $3,941.45 |

| Campaign | $3,945.78 |

| Spring Creek | $3,963.50 |

| Mason | $3,966.47 |

| Oakland | $3,971.25 |

| Moscow | $4,004.99 |

| Covington | $4,010.68 |

| Silerton | $4,029.52 |

| Williston | $4,036.66 |

| Rossville | $4,041.12 |

| Burlison | $4,042.45 |

| Munford | $4,056.03 |

| Atoka | $4,075.14 |

| Eads | $4,080.50 |

| Drummonds | $4,094.22 |

| Ellendale | $4,102.16 |

| Brighton | $4,105.10 |

| Collierville | $4,107.47 |

| Arlington | $4,114.08 |

| Millington | $4,172.26 |

| Germantown | $4,184.91 |

| Cordova | $4,314.74 |

| Bartlett | $4,343.08 |

| Memphis | $4,788.94 |

As you can see, where you live can have a sizeable impact on your car insurance rates.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Tennessee Car Insurance Companies

The best car insurance company for you depends on a number of factors, from family status to driving record to credit history.

Not surprisingly, you’ll want to consider the pros and cons of each insurer.

For our compilation of the best car insurance companies in Tennessee, check out the sections below.

The Largest Companies Financial Rating

A.M. Best Financial Rating informs consumers of the financial strength of a particular insurance company. Here are their financial ratings for the biggest insurers in Tennessee:

Financial Ratings for Tennesse's Largest Car Insurance Companies

| Company | AM Best Rating |

|---|---|

| State Farm Group | A++ |

| Tennessee Farmers Group | A+ |

| Geico | A++ |

| Progressive Group | A+ |

| Allstate Insurance Group | A+ |

| USAA Group | A++ |

| Liberty Mutual Group | A |

| Nationwide Corp Group | A+ |

| Erie Insurance Group | A+ |

| Travelers Group | A++ |

Watch this video to learn more about the importance of checking out the financial rating of your car insurance company.

Companies with Best Ratings

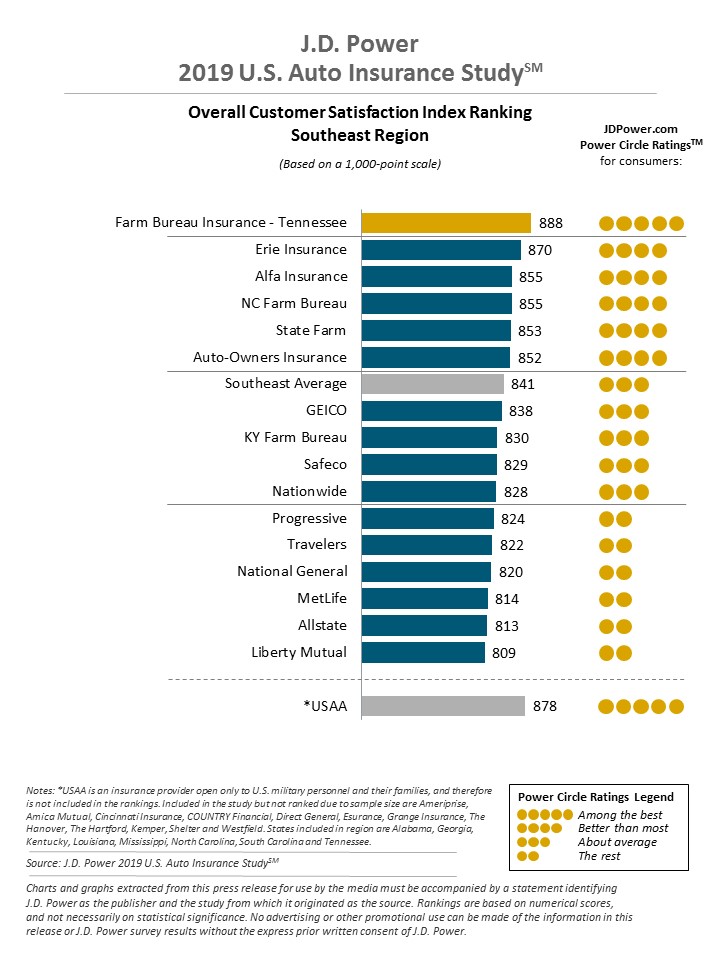

You might expect a large national company with zippy commercials — think geckos or cashiers named Flo — to get the best ratings for car insurance, but J.D. Power and Associates recently ranked Farm Bureau Insurance – Tennessee the best auto insurer in the state.

Here are their 2018 rankings for the Southeast region, which includes Tennessee:

Companies with Most Complaints in Tennessee

Knowing how many complaints a car insurance provider receives can certainly help you determine who is the best car insurer for you and your family.

The table below offers the complaint ratios for the biggest auto insurers in The Volunteer State by market share.

Complaint Ratios for Tennesee's Largest Car Insurance Companies

| Companies | Number of Complaints |

|---|---|

| Travelers | 2 |

| Erie Insurance | 22 |

| Nationwide | 25 |

| Tennessee Farmers | 39 |

| Progressive | 120 |

| Allstate | 163 |

| Liberty Mutual | 222 |

| USAA | 296 |

| Geico | 333 |

| State Farm | 1482 |

CHEAPEST Companies in Tennessee

All things considered, State Farm is the cheapest car insurance company in Tennessee on average. They also don’t have a high ratio of customer complaints and have an above-average financial rating.

With a state average of $3,660.89 for annual car insurance premiums, here are the cheapest insurers in Tennessee:

Tennessee Average Annual Auto Insurance Rates by Company

| Companies | Average Annual Auto Insurance Rates |

|---|---|

| Allstate P&C | $4,828.85 |

| Mid-Century Ins Co | $3,430.07 |

| Geico General | $3,283.42 |

| SAFECO Ins Co of IL | $6,206.69 |

| Nationwide Mutual | $3,424.96 |

| Progressive Hawaii | $3,656.91 |

| State Farm Mutual Auto | $2,639.30 |

| Travelers Prop Cas Ins Co | $2,738.52 |

| USAA | $2,739.28 |

Commute Rates by Companies

Many folks don’t know that the length of their commute can affect their car insurance rates.

Some, but not all, insurers will raise your rates if you have a longer commute.

Here’s a list of the average premiums we found based on 10- and 25-mile commutes for the top-10 insurers in Tennessee:

Tennesee Average Annual Car Insurance Rates by Commute

| Companies | Average Annual Rates for 10 Miles Commute 6,000 Annual Mileage | Average Annual Rates for 25 Miles Commute 12,000 Annual Mileage |

|---|---|---|

| State Farm | $2,576.56 | $2,702.04 |

| Travelers | $2,630.93 | $2,846.10 |

| USAA | $2,661.90 | $2,816.66 |

| Geico | $3,263.57 | $3,303.27 |

| Nationwide | $3,424.96 | $3,424.96 |

| Farmers | $3,430.06 | $3,430.06 |

| Progressive | $3,656.91 | $3,656.91 |

| Allstate | $4,828.85 | $4,828.85 |

| Liberty Mutual | $6,206.69 | $6,206.69 |

Remember that as Tennessee grows, commute times are likely to grow, too. The Nashville Metro Statistical Area already has a commute time of 27 minutes each way, a recent study finds, above the national average.

Coverage Level Rates by Companies

The more insurance, the higher the premium, right? Often, but not always.

In Tennessee, for instance, a high level of coverage with State Farm will only cost you a few hundred dollars a year more than the bare minimum.

And as we know, more insurance equals more protection when it comes to you and your family’s driving. The table below provides averages rates for low, medium, and high coverage levels for the top 10 insurance providers in Tennessee.

Tennessee Average Annual Car Insurance Rates by Coverage Level

| Companies | Average Annual Rate with Low Coverage | Average Annual Rate with Medium Coverage | Average Annual Rate with High Coverage |

|---|---|---|---|

| State Farm | $2,492.73 | $2,651.21 | $2,773.95 |

| Travelers | $2,576.37 | $2,736.50 | $2,902.69 |

| USAA | $2,651.70 | $2,729.45 | $2,836.70 |

| Geico | $3,125.46 | $3,276.37 | $3,448.43 |

| Farmers | $3,236.69 | $3,413.80 | $3,639.71 |

| Progressive | $3,428.80 | $3,657.30 | $3,884.63 |

| Nationwide | $3,450.27 | $3,350.97 | $3,473.64 |

| Allstate | $4,645.25 | $4,816.41 | $5,024.87 |

| Liberty Mutual | $5,938.19 | $6,204.78 | $6,477.10 |

Credit History Rates by Companies

Tennesseans have an average Vantage credit score of 662, just below the national average of 675. (They also have an average of 2.77 credit cards with an average total credit card balance of $5,975.)

Your credit history is a key factor car insurance providers take into account when figuring your car insurance premium.

Whether you have good, fair, or poor credit, here’s some information you should know about different companies in The Volunteer State:

Tennessee Average Annual Car Insurance Rates by Credit History

| Companies | Average Annual Rate with Good Credit | Average Annual Rate with Fair Credit | Average Annual Rate with Poor Credit |

|---|---|---|---|

| State Farm | $1,785.62 | $2,299.30 | $3,832.98 |

| USAA | $1,918.82 | $2,326.47 | $3,972.56 |

| Travelers | $1,996.22 | $2,735.47 | $3,483.87 |

| Nationwide | $2,894.15 | $3,265.47 | $4,115.26 |

| Geico | $2,933.59 | $3,190.30 | $3,726.36 |

| Farmers | $3,019.09 | $3,191.56 | $4,079.54 |

| Progressive | $3,314.09 | $3,545.77 | $4,110.86 |

| Allstate | $3,604.43 | $4,718.43 | $6,163.68 |

| Liberty Mutual | $4,266.12 | $5,455.32 | $8,898.63 |

But what affects your car insurance premium even more than your credit history? Your driving record.

Driving Record Rates by Companies

Is your driving record squeaky clean? Or do you have a few, uh, infractions on your road rap sheet?

Either way, your driving record is perhaps the top thing insurers take into account when calculating what it will cost to insure you.

In Tennessee, Geico will likely not penalize you for a single speeding ticket, whereas your premiums with them can almost double if you have a DUI in your past. The table below illustrates how Tennessee’s top insurers consider a speeding ticket, an accident, or a DUI in determining your car insurance premium.

Tennessee Average Annual Car Insurance Rates by Driving History

| Companies | Average Annual Rates with a Clean Record | Average Annual Rates with 1 Accident | Average Annual Rates with 1 DUI | Average Annual Rates with 1 Speeding Violation |

|---|---|---|---|---|

| USAA | $1,992.65 | $2,984.18 | $3,509.42 | $2,470.89 |

| Travelers | $2,220.52 | $2,851.81 | $3,150.18 | $2,731.56 |

| Geico | $2,386.13 | $3,197.12 | $5,164.31 | $2,386.13 |

| State Farm | $2,406.95 | $2,871.65 | $2,639.30 | $2,639.30 |

| Farmers | $2,930.61 | $3,622.99 | $3,709.20 | $3,457.46 |

| Nationwide | $2,961.85 | $2,961.85 | $4,454.01 | $3,322.14 |

| Progressive | $3,221.09 | $4,182.08 | $3,430.36 | $3,794.09 |

| Allstate | $4,043.94 | $4,821.64 | $5,823.95 | $4,625.86 |

| Liberty Mutual | $5,031.00 | $7,257.06 | $6,748.89 | $5,789.80 |

Largest Car Insurance Companies in Tennessee

Are the biggest insurance companies always the cheapest? Not always, but they can often extend more affordable premiums to their customers because they’re receiving more in annual premiums — it’s almost like buying in bulk at Sam’s Club or Costco.

The table below offers the top 10 auto insurers in Tennessee by their market share, direct premiums written, and loss ratio.

Tennessee's Largest Car Insurance Companies by Direct Premiums Written

| Companies | AM Best Rating | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| Allstate Insurance Group | A+ | $254,285 | 47.23% | 6.23% |

| Erie Insurance Group | A+ | $114,508 | 76.69% | 2.80% |

| Geico | A++ | $348,059 | 69.97% | 8.52% |

| Liberty Mutual Group | A | $211,928 | 62.66% | 5.19% |

| Nationwide Corp Group | A+ | $171,166 | 68.01% | 4.19% |

| Progressive Group | A+ | $311,706 | 61.15% | 7.63% |

| State Farm Group | A++ | $948,604 | 62.03% | 23.23% |

| Tennessee Farmers Group | A+ | $654,613 | 74.33% | 16.03% |

| Travelers Group | A++ | $84,329 | 64.98% | 2.06% |

| USAA Group | A++ | $221,585 | 71.72% | 5.43% |

Number of Foreign vs. Domestic Insurers in Tennessee

What’s a foreign insurance company, and what’s a domestic insurance company? Unlike foreign and domestic when it comes to actual car talk, if you’re talking insurance providers, you’re talking about the number of in-state vs. out-of-state companies.

In Tennessee, there are 15 domestic car insurance providers vs. 930 foreign providers operating in the state.

How Much Car Insurance Rates in Tennessee

Investigate the variability of car insurance rates across different cities in Tennessee. Select your city from the provided list to obtain detailed information regarding insurance costs specific to your area.

| Find Affordable Car Insurance Rates in Tennessee | ||

|---|---|---|

| Bristol, TN | Gallatin, TN | Nashville, TN |

| Centerville, TN | Jackson, TN | Newport, TN |

| Chattanooga, TN | Knoxville, TN | Rogersville, TN |

| Clarksville, TN | Loudon, TN | Tazewell, TN |

| Crossville, TN | Memphis, TN | |

| Dandridge, TN | Murfreesboro, TN |

Tennessee Laws

Do you know the particular laws for Tennessee? For instance, you have to have your headlights on when windshield wipers are in use?

Each state has a unique set of laws, and we’re here to help you navigate the insurance and driving laws of The Volunteer State.

Here’s another resource to check out, whether you’re a Tennessee native or just passing through: the National Motorists Association guide to driving in the state.

Car Insurance Laws

As we discussed above, your minimum Tennessee coverage must include:

- $25,000 per person — to cover the bodily injury or death of an individual resulting from an accident you cause

- $50,000 per accident — to cover the total bodily injury or death liability resulting from an accident you cause

- $15,000 property damage liability coverage — to cover the total costs of another party or party’s property damage resulting from an accident you cause

And remember, these are minimums. Your driving record, your credit history, and your typical commute might mean more comprehensive coverage will serve you and your family best.

How State Laws for Insurance are Determined

How do insurance laws get made? Is it as simple as Schoolhouse Rock taught us?

https://www.youtube.com/watch?v=FFroMQlKiag

When it comes to car insurance state-to-state, it might not be that simple. But, The National Association of Insurance Commissioners (NAIC) is the U.S. standard-setting and regulatory support organization created and governed by the chief insurance regulators from across the country. They offer this great guide to understanding how insurance laws get made.

Windshield Coverage

You might already know that a lot of states require a waived deductible if you need glass repairs done on your car. Some even make it mandatory to use only original manufacturer replacement parts.

Right now, The Volunteer State doesn’t have any laws in place unique to windshield insurance coverage, such as a preferred repair shop choice or the use of original manufacturer parts instead of aftermarket ones.

But remember, windshield or glass coverage might be an easy add-on to your insurance policy. Which is good, considering glass claims are the number one claim type across the nation.

High-Risk Insurance

Like a lot of states, Tennessee uses a points system, administered through their Department of Safety & Homeland Security.

As you might expect, the more points you have on your record, the higher your car insurance premium is likely to be.

So, what happens if your record includes so many points that every car insurance provider you contact rejects taking you on as a client? If you’re a Tennessee driver, you might be in luck. The state participates in a government-backed program for eligible drivers, the Tennessee Automobile Insurance Plan (TNAIP).

Automobile Insurance Fraud in Tennessee

What is insurance fraud, anyway? Essentially, insurance fraud is when someone tries to benefit, financially or otherwise, in the course of an insurance transaction that they would not otherwise be due. This can include lying or misrepresenting the facts of the scenario.

Tennessee takes insurance fraud very seriously. If you’re convicted of fraud in the state, you face these hefty penalties:

- Fraudulent acts involving $500 or under for property or services acquired are categorized as a Class A Misdemeanor, punishable by under 11 months and 29 days imprisonment and fines up to $2,500.

- Fraudulent acts involving $500 to $10,000 acquired are categorized as a Class E Felony, punishable by 1-6 years imprisonment and up to $3,000 in fines.

- Fraudulent acts involving $1,000 to $10,000 acquired are categorized as a Class D Felony, punishable by 2-12 years imprisonment and up to $5,000 in fines.

- Fraudulent acts involving $10,000 to $60,000 acquired are categorized as a Class C Felony, punishable by 3-15 years imprisonment and up to $10,000 in fines.

- Fraudulent acts involving $60,000 or more acquired are categorized as a Class B Felony, punishable by 8-30 years imprisonment and up to $25,000 in fines.

We think it’s best you just avoid the situation altogether by not committing insurance fraud.

Statute of Limitations

Did you know there’s a limit on the amount of time you have to bring a lawsuit to court? That’s called a statute of limitations.

The Volunteer State is fairly strict when it comes to personal injury or property damage statute of limitations following an accident. In Tennessee, you have one year following an accident to file in a court of law.

State Specific Laws

Every state has its quirks when it comes to driving and insurance laws. For instance, in Tennessee, you always have the right to a trial by a jury of their peers, whether your infraction is a speeding ticket or a DUI.

The National Motorists Association provides a thorough guide to Tennessee-specific laws.

Vehicle Licensing Laws

According to the Tennessee Department of Safety & Homeland Security, anyone operating a passenger vehicle in the state needs a Class D license. If you’re new to the state, you have 30 days to get one. If you’re a teen, there are some unique regulations specific to your age group in obtaining a license.

Check out the sections below to learn more about vehicle licensing laws in The Volunteer State.

Real ID

Federal REAL ID laws can affect your travel, especially if you’re traveling by air. So it’s good to know before you go.

Tennessee is in compliance with the REAL ID Act, which means that Federal agencies can accept IDs and drivers licenses from the state to conduct government business and to enter at federal facilities.

Teen Driver Laws

In Tennessee, teen drivers must be at least 15 years of age to get their learner’s permit. To move to an intermediate license, they must be at least 16 years of age and:

- Hold their learner’s permit for at least six months

- Complete a minimum 50 hours of supervised driving, 10 of which must be at nighttime

But even with an intermediate license, there are some restrictions for teen drivers. These include:

- No unsupervised driving between the hours of 11 P.M. and 6 A.M.

- No more than one non-family member passenger

The nighttime and passenger restrictions can be lifted after 12 months or once the driver turns 18, whichever happens first. The Department of Safety & Homeland Security in Tennessee provides most of the documents needed for teen drivers online.

Older Driver License Renewal Procedures

Tennessee’s older drivers don’t differ greatly in their renewal procedures from younger citizens.

Both general and older drivers can renew in-person, by mail, or online. Drivers must renew once every eight years and proof of adequate vision is not required after obtaining an initial Class D license in Tennessee.

New Residents

It’s not too hard to get a drivers license if you’re new to Tennessee, which you must do within 30 days of obtaining residency in the state.

According to the state’s Department of Safety & Homeland Security, new residents and returning residents who need to exchange the license from their former state of residence must present:

- Your current license (or certified copy of driving record or other acceptable ID).

(The certified copy of your driving record, known as a Motor Vehicle Record (MVR), must be an original (no photocopies) and issued no more than 30 days prior to your Tennessee application date.) - Proof of name change, such as original certified court order, marriage certificate, or divorce decree.

- Two Proofs of Tennessee Residency with your name and resident address – NO P.O. BOXES (Documents must be current. Must be dated within the last four months.)

- Proof of U.S. Citizenship, Lawful Permanent Resident Status or Proof of authorized stay or temporary legal presence in the United States

- A Social Security Number or sworn affidavit if no Social Security number has been issued.

License renewal procedures

You’ll want to check Tennessee’s Department of Safety & Homeland Security’s “Renewing Your License” guide to see how easy it can be to renew your license in The Volunteer State.

Rules of the Road

Tennessee roadways are beautiful, snaking through the Smoky Mountains in the east, and along the Mighty Mississippi River in the west.

Knowing the rules of the state’s roads will not only keep you safe but will also keep your insurance more affordable.

In the sections below, we’ll cover some key features of The Volunteer State’s transportation laws.

Fault vs. No-Fault

Tennessee is a traditional fault state, meaning the driver found responsible for the car accident is also responsible for all ensuing costs.

These at-fault costs might include injuries, lost income, vehicle damage, and so on.

The more comprehensive your insurance, the better prepared you are to face accidents and other auto incidents head-on, whether or not you are found at fault.

Seat belt and car seat laws

According to the Tennessee Highway Safety Office, “drivers are required to wear safety belts at all times when operating a motor vehicle in Tennessee. All drivers and front-seat passengers are covered by the seat belt law and must have a seat belt properly fastened about their bodies at all times when the vehicle is in a forward motion.”

It’s important to buckle up. The National Highway Transportation and Safety Administration report that nearly half (48 percent) of the passenger vehicle occupants killed in crashes in 2016 were not wearing seat belts.

There are specific laws in Tennessee for children less than age 18, who are covered under the Tennessee Child Passenger Safety and Graduated Driver Licensing laws. In fact, in 1977 Tennessee became the first state to pass a car seat law.

Check out the Highway Safety Office’s comprehensive guide for securely and legally driving with your child in Tennessee.

Keep Right and Move Over Laws

In 2016, Tennessee passed a “Slow Poke Law.” According to TrackBill, Tennessee SB1608 “prohibits a person from operating a vehicle in the passing lane on an interstate or multilane divided highway that has three or more lanes in each direction, except when overtaking or passing a vehicle that is in a non-passing lane.

A violation will be a Class C misdemeanor punishable by a fine only of $50.00.”

Remember, such violations can increase your car insurance premiums by adding points to your driving record.

Tennessee’s Move Over Law requires drivers nearing stationary emergency vehicles to lower their speed and move over to the closest lane if it is possible and safe to do so. Fail to do so and you can be fined up to $500.

Speed Limits

Tennessee’s speed limits are what we call absolute, which means you violate the law by driving even just one mph over the posted speed limit.

And remember, our research shows that speeding is one of the easiest ways to increase your car insurance premium.

In The Volunteer State, the maximum posted speed limits for both cars and trucks are:

- Rural Interstates: 70 mph

- Urban Interstates: 70 mph

- Other Limited Access Roads: 65 mph

Slow down to keep you and your family safe. Oh, and to keep your car insurance affordable.

Ridesharing

When it comes to taking rideshare options like Uber or Lyft, folks often find insurance liability to be murky waters. But such companies’ driver requirements are pretty clear: most rideshare services require that all their drivers carry personal car insurance policies that align or exceed the minimum coverages dictated by state law.

So don’t fret if you need a lift from Beale Street in Memphis.

Automation on the Road

According to the Insurance Institute for Highway Safety (IIHS), Tennessee has authorized the deployment of autonomous vehicles. Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human, like radars, cameras, or other sensors.

A key fact to automated driving in Tennessee: though the operator does not need to be licensed or even be in the vehicle, they must maintain liability insurance of at least $5,000,000.

Safety Laws

Wherever you are, driving safely is key to not only saving on car insurance but also staying alive.

Now that we’ve gone over the proper way to insure and register your vehicle in Tennessee, let’s cover some important information about keeping you, your family, and your vehicles safe in The Volunteer State.

DUI Laws

Put simply: don’t drink and drive.

If you find yourself ticketed with drunk driving from a little too much Tennessee whiskey, some hefty fines are headed your way. Below are Tennessee’s DUI laws.

First-time offenders receive:

- Mandatory jail time of up to 48 hours, and up to 11 months and 29 days in jail.

- A fine between $350-$1,500.

- Revocation of license up to one year.

- Mandatory attendance of an alcohol and drug treatment program.

Second-time offenders receive:

- Mandatory jail time of up to 45 days and a max of up to one year.

- A fine between $600-$3,500.

- Revocation of license for up to two years. After you get your license back can only be used in specific circumstances.

- Possible confiscation of the vehicle.

Third-time offenders receive:

- Mandatory jail time of up to 120 days and a max of one year.

- A fine between $1,100-$10,000.

- Revocation of license anywhere from 6-10 years.

- No possibility of getting a restricted license.

Fourth and subsequent offenders receive:

- Mandatory jail time of a minimum of one year.

- A fine between $3,000-$15,000.

- Revocation of license for eight years.

- No possibility of getting a restricted license.

Judges can order restitution to any person you harmed for any DUI. Also, you will pay fees to get your license reinstated, SR-22 fees, and other various fees.

https://www.youtube.com/watch?v=kEuTKl4jssY

Marijuana-Impaired Driving Laws

Though Tennessee has yet to enact a marijuana-impaired driving law, with marijuana decriminalization and legalization on the uptrend, it’s probably only a matter of time.

Distracted Driving Laws

No matter how old you are or what kind of license you carry, you can’t use a hand-held device in Tennessee as of July 1, 2019.

And importantly, the hand-held device ban is primarily enforced, meaning a police officer can pull you over for no other reason than sending a text.

Driving Safely in Tennessee

Now that you’ve learned some of the basic rules of the road in The Volunteer State, let’s look at some key driver safety statistics.

Vehicle Theft in Tennessee

Tennessee is known for its friendliness. But that doesn’t mean vehicle theft isn’t a problem.

The FBI tracks vehicle theft in all states, and reports that in 2016 alone, 3,234 were stolen in Memphis alone.

The table below offers the top 10 stolen vehicles in the state of Tennessee in 2016, including the most popular model year stolen.

Most Stolen Vehicles in Tennessee

| Vehicle Make and Model | Model Year | Number of Vehicles Stolen |

|---|---|---|

| Chevrolet Pickup (Full Size) | 1997 | 693 |

| Ford Pickup (Full Size) | 2004 | 468 |

| Honda Accord | 1996 | 267 |

| Nissan Altima | 2005 | 215 |

| Chevrolet Impala | 2007 | 213 |

| GMC Pickup (Full Size) | 1996 | 201 |

| Honda Civic | 2000 | 198 |

| Nissan Maxima | 1997 | 188 |

| Toyota Camry | 2007 | 188 |

| Jeep Cherokee/Grand Cherokee | 2000 | 178 |

Road Fatalities in Tennessee

Sadly, traffic fatalities are on the rise in The Volunteer State. For 2018, the Tennessee Department of Safety & Homeland Security reported 1,047 fatalities, a 2.2 percent increase over 2017.

As the state continues to grow, so, too, will the number of traffic fatalities. Use the safety information below to drive more alertly in Tennessee.

Most fatal highway in Tennessee

In Tennessee, the most fatal highway is I-40, which sees over 400 crashes a year.

Fatal Crashes by Weather Condition and Light Condition

You’re probably not surprised to learn that crashes are highly determinate by weather and light conditions. This is especially true in Tennessee’s biggest metro areas, Nashville and Memphis.

The table below provides the number of fatal crashes by weather and light conditions across Tennessee in 2017.

Tennessee Fatal Crashes by Weather and Light Conditions

| Weather Conditions | Fatal Crashes in Daylight Conditions | Fatal Crashes in Dark, but Lighted Conditions | Fatal Crashis in Dark Conditions | Fatal Crashes at Dawn or Dusk | Other / Unknown Fatal Crashes | Total Fatal Crashes |

|---|---|---|---|---|---|---|

| Normal | 443 | 134 | 236 | 22 | 3 | 838 |

| Rain | 51 | 18 | 24 | 3 | 0 | 96 |

| Snow/Sleet | 1 | 0 | 1 | 0 | 0 | 2 |

| Other | 1 | 4 | 6 | 3 | 0 | 14 |

| Unknown | 2 | 1 | 2 | 0 | 4 | 9 |

Fatalities (All Crashes) by County

Use the table below to search for the number of crashes for the 25 Tennesee counties with the most fatalities in 2017.

25 Tennessee Counties with the Most Fatal Vehicle Crashes

| Counties | 2017 Fatalities | 2017 Fatalities Per 100K Population |

|---|---|---|

| Shelby County | 122 | 13.02 |

| Davidson County | 75 | 10.85 |

| Knox County | 57 | 12.34 |

| Rutherford County | 39 | 12.3 |

| Montgomery County | 30 | 14.99 |

| Hamilton County | 27 | 7.47 |

| Williamson County | 25 | 11.05 |

| Sevier County | 20 | 20.48 |

| Maury County | 19 | 20.62 |

| Wilson County | 19 | 13.93 |

| Greene County | 18 | 26.16 |

| Coffee County | 17 | 30.89 |

| Sullivan County | 17 | 10.82 |

| Warren County | 17 | 41.82 |

| Blount County | 16 | 12.31 |

| Dickson County | 16 | 30.27 |

| Bradley County | 15 | 14.21 |

| Hawkins County | 14 | 24.8 |

| Loudon County | 14 | 26.84 |

| Roane County | 14 | 26.4 |

| Henry County | 13 | 40.06 |

| Hickman County | 13 | 52.28 |

| Madison County | 13 | 13.31 |

| Monroe County | 13 | 28.11 |

Traffic Fatalities

Urban and rural traffic fatalities were pretty evenly split in Tennessee for 2017, as the table below illustrates.

Tennessee Rural vs. Urban Traffic Fatalities

| Area | 2013 Fatalities | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities |

|---|---|---|---|---|---|

| Rural | 534 | 454 | 482 | 465 | 500 |

| Urban | 461 | 509 | 478 | 568 | 538 |

| Unknown | 0 | 0 | 2 | 4 | 2 |

| Total | 995 | 963 | 962 | 1,037 | 1,040 |

Fatalities by Person Type

Road fatalities aren’t just those driving or riding in a passenger vehicle.

The table below breaks down 2017 Tennessee vehicle fatalities by person type, whether an occupant of an enclosed vehicle, a motorcyclist, or a nonoccupant.

Tennessee Vehicle Fatalities by Person Type

| Person Type | 2013 Fatalities | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities |

|---|---|---|---|---|---|

| Passenger Car | 425 | 395 | 375 | 418 | 436 |

| Light Truck - Pickup | 149 | 155 | 145 | 137 | 141 |

| Light Truck - Utility | 114 | 118 | 129 | 146 | 118 |

| Light Truck - Van | 31 | 30 | 38 | 30 | 37 |

| Large Truck | 19 | 24 | 21 | 21 | 24 |

| Bus | 8 | 3 | 0 | 6 | 0 |

| Other/Unknown Occupants | 17 | 23 | 9 | 20 | 15 |

| Total Occupants | 763 | 748 | 718 | 779 | 771 |

| Light Truck - Other | 0 | 0 | 1 | 1 | 0 |

| Total Motorcyclists | 138 | 120 | 123 | 147 | 134 |

| Pedestrian | 80 | 86 | 104 | 97 | 124 |

| Bicyclist and Other Cyclist | 8 | 5 | 10 | 9 | 8 |

| Other/Unknown Nonoccupants | 6 | 4 | 7 | 5 | 3 |

| Total Nonoccupants | 94 | 95 | 121 | 111 | 135 |

| Total | 995 | 963 | 962 | 1,037 | 1,040 |

Fatalities by Crash Type

This table breaks down 2017 vehicle fatalities by crash type across Tennessee.

Tennessee Vehicle Fatalities by Crash Type

| Crash Type | 2013 Fatalities | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities |

|---|---|---|---|---|---|

| Single Vehicle | 554 | 555 | 524 | 573 | 585 |

| Involving a Large Truck | 127 | 110 | 116 | 120 | 136 |

| Involving Speeding | 239 | 220 | 189 | 183 | 166 |

| Involving a Rollover | 294 | 271 | 259 | 298 | 261 |

| Involving a Roadway Departure | 624 | 605 | 595 | 652 | 665 |

| Involving an Intersection (or Intersection Related) | 184 | 154 | 164 | 158 | 158 |

| Total Fatalities (All Crashes) | 995 | 963 | 962 | 1,037 | 1,040 |

Five-Year Trend For The Top 10 Counties

The more populous the county, the more road fatalities. This table offers the five-year trend for Tennessee’s 10 biggest counties.

Tennessee Five-Year Vehicle Fatality Trend

| Counties | 2013 Fatalities | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities |

|---|---|---|---|---|---|

| Davidson County | 71 | 64 | 76 | 71 | 75 |

| Hamilton County | 43 | 42 | 42 | 39 | 27 |

| Knox County | 60 | 56 | 54 | 70 | 57 |

| Maury County | 17 | 19 | 10 | 18 | 19 |

| Montgomery County | 22 | 28 | 27 | 28 | 30 |

| Rutherford County | 27 | 35 | 25 | 43 | 39 |

| Sevier County | 13 | 16 | 16 | 15 | 20 |

| Shelby County | 99 | 107 | 120 | 132 | 122 |

| Williamson County | 17 | 16 | 10 | 13 | 25 |

| Wilson County | 20 | 20 | 16 | 23 | 19 |

Fatalities Involving Speeding by County

Use the table below to search for the number of fatalities resulting from crashes involving speeding by county across Tennessee in 2017.

Tennessee Top 25 Counties for Speeding-Related Fatalities

| Counties | 2017 Fatalities | 2017 Fatalities Per 100K Population |

|---|---|---|

| Shelby County | 28 | 2.99 |

| Knox County | 12 | 2.6 |

| Davidson County | 9 | 1.3 |

| Montgomery County | 9 | 4.5 |

| Hamilton County | 7 | 1.94 |

| Rutherford County | 7 | 2.21 |

| Sullivan County | 6 | 3.82 |

| Bradley County | 4 | 3.79 |

| Hancock County | 4 | 60.61 |

| Roane County | 4 | 7.54 |

| Sumner County | 4 | 2.18 |

| Blount County | 3 | 2.31 |

| Decatur County | 3 | 25.53 |

| Dyer County | 3 | 8.01 |

| Mcminn County | 3 | 5.67 |

| Polk County | 3 | 17.9 |

| Sevier County | 3 | 3.07 |

| Williamson County | 3 | 1.33 |

| Anderson County | 2 | 2.62 |

| Bledsoe County | 2 | 13.59 |

| Cocke County | 2 | 5.62 |

| Greene County | 2 | 2.91 |

| Hamblen County | 2 | 3.11 |

| Johnson County | 2 | 11.31 |

| Marion County | 2 | 7.04 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

Counties with major metros or universities are sadly more prone to fatalities in crashes involving an alcohol-impaired driver, as this searchable table illustrates.

Tennessee's Top 25 Counties for Alcohol-Related Vehicle Fatalities

| Counties | 2017 Fatalities | 2017 Fatalities Per 100K Population |

|---|---|---|

| Shelby County | 40 | 4.27 |

| Davidson County | 22 | 3.18 |

| Knox County | 14 | 3.03 |

| Rutherford County | 9 | 2.84 |

| Hamilton County | 7 | 1.94 |

| Montgomery County | 7 | 3.5 |

| Warren County | 6 | 14.76 |

| Williamson County | 6 | 2.65 |

| Hawkins County | 5 | 8.86 |

| Lauderdale County | 5 | 19.78 |

| Madison County | 5 | 5.12 |

| Roane County | 5 | 9.43 |

| Sevier County | 5 | 5.12 |

| Bradley County | 4 | 3.79 |

| Hancock County | 4 | 60.61 |

| Jefferson County | 4 | 7.43 |

| Scott County | 4 | 18.19 |

| Anderson County | 3 | 3.93 |

| Bledsoe County | 3 | 20.38 |

| Coffee County | 3 | 5.45 |

| Fayette County | 3 | 7.49 |

| Franklin County | 3 | 7.2 |

| Greene County | 3 | 4.36 |

| Henry County | 3 | 9.24 |

| Jackson County | 3 | 25.69 |

Teen Drinking and Driving

On average, teen drinking and driving is less of a problem in Tennessee than it is across the United States. The table below offers some key stats on the state’s issues surrounding teens and drunk driving.

Tennessee Teen DUI Arrests

| DUI Arrest (Under 18 years old) | DUI Arrests (Under 18 years old) Total Per Million People | Rank |

|---|---|---|

| 143 | 95.22 | 21 |

EMS Response Time

In Tennessee, EMS response time is largely dependent on a crash happening in an urban or rural area.

This table shows the average EMS response time for urban and rural areas of Tennessee, from time of the crash to EMS notification to time of the crash to hospital arrival.

Tennessee Rural vs. Urban EMS Response Times

| EMS Response | Rural | Urban |

|---|---|---|

| Time of Crash to EMS Notification | 8.96 mins | 4.09 mins |

| EMS Notification to EMS Arrival | 12.65 mins | 8.21 mins |

| EMS Arrival at Scene to Hospital Arrival | 50.09 mins | 33.65 mins |

| Time of Crash to Hospital Arrival | 61.68 mins | 43.12 mins |

| Total Fatal Crashes | 455 | 502 |

Transportation in Tennessee

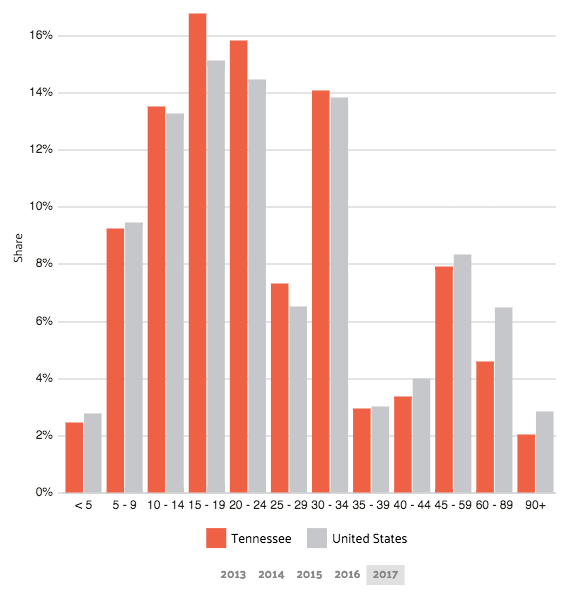

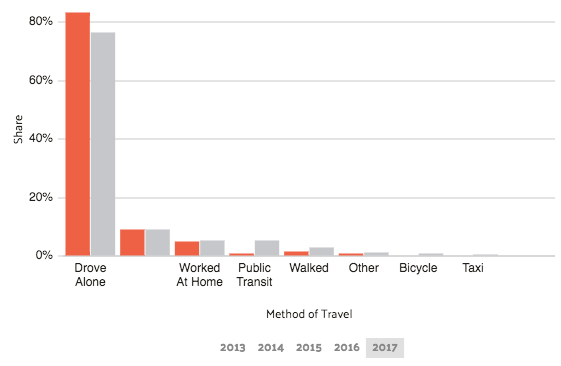

If you call Tennessee home, you likely live in a household with two or more vehicles, drive alone to work, and have an average commute time of 23.9 minutes each way, just below the national average.

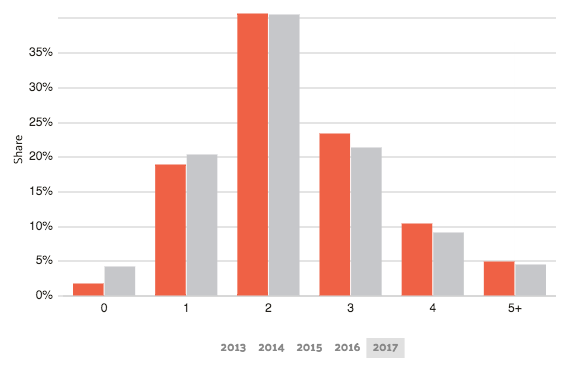

Car Ownership

As DataUSA shows in the graph below, Tennesseans really like their cars.

Commute Time

As we’ve already seen, Tennesseans have relatively short commutes: only 23.9 minutes each way compared to an American average of 26.1 minutes.

Commuter Transportation

Outside of Nashville and Memphis, commuter transportation is largely not an option in The Volunteer State.

Traffic Congestion

A lot of Tennessee is rural, but more and more of the state is becoming developed. This is especially true in the regions surrounding Nashville and Memphis.

Nashville residents lose, on average, 87 hours per year stuck in traffic! The table below offers some key statistics on traffic congestion in Nashville and Memphis.

Traffic Congestion in Tennessee

| Cities | 2018 World Rank | Hours Lost in Congestion | Cost of Congestion (per driver) | Inner City Travel Time (minutes) |

|---|---|---|---|---|

| Nashville | 114 | 87 | $1,221 | 4 |

| Memphis | 211 | 38 | $530 | 3 |

When it comes to thinking about car insurance in Tennessee, what section of this guide did you find most helpful?

Are you ready to find the best quotes for your next insurance decision?

Just enter your zip code below to get started.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is the minimum car insurance requirement in Tennessee?

In Tennessee, drivers are required to have liability car insurance with at least $25,000 in coverage for bodily injury per person, $50,000 in coverage for bodily injury per accident, and $15,000 in coverage for property damage per accident.

How can I compare car insurance costs and companies in Tennessee?

To compare car insurance costs and companies in Tennessee, you can use online comparison tools, such as NerdWallet or The Zebra. You can also contact local insurance agents and ask for quotes from multiple companies.

What factors affect the cost of my car insurance in Tennessee?

The cost of car insurance in Tennessee is affected by several factors, including your age, gender, driving record, the type of car you drive, and your location.

What car insurance companies are available in Tennessee?

There are several car insurance companies available in Tennessee, including State Farm, Geico, Allstate, Progressive, and Farm Bureau.

How can I find the best car insurance company for me in Tennessee?

To find the best car insurance company for you in Tennessee, you should compare quotes from multiple companies, read customer reviews, and consider factors like coverage options, customer service, and financial stability.

Are there any discounts available for car insurance in Tennessee?

Yes, car insurance companies in Tennessee offer several discounts, such as safe driver discounts, good student discounts, multiple vehicle discounts, and bundling discounts.

Can I get car insurance with a bad driving record in Tennessee?

Yes, you can still get car insurance with a bad driving record in Tennessee, but you may have to pay higher premiums. You may also need to consider high-risk car insurance options.

What is the average cost of car insurance in Tennessee?

Tennessee minimum liability insurance is an average of $31 per month, and Tennessee full coverage insurance is an average of $111 per month.

What is the cheapest full coverage car insurance in Tennessee?

Companies like Geico and State Farm usually have the cheapest full coverage car insurance.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.